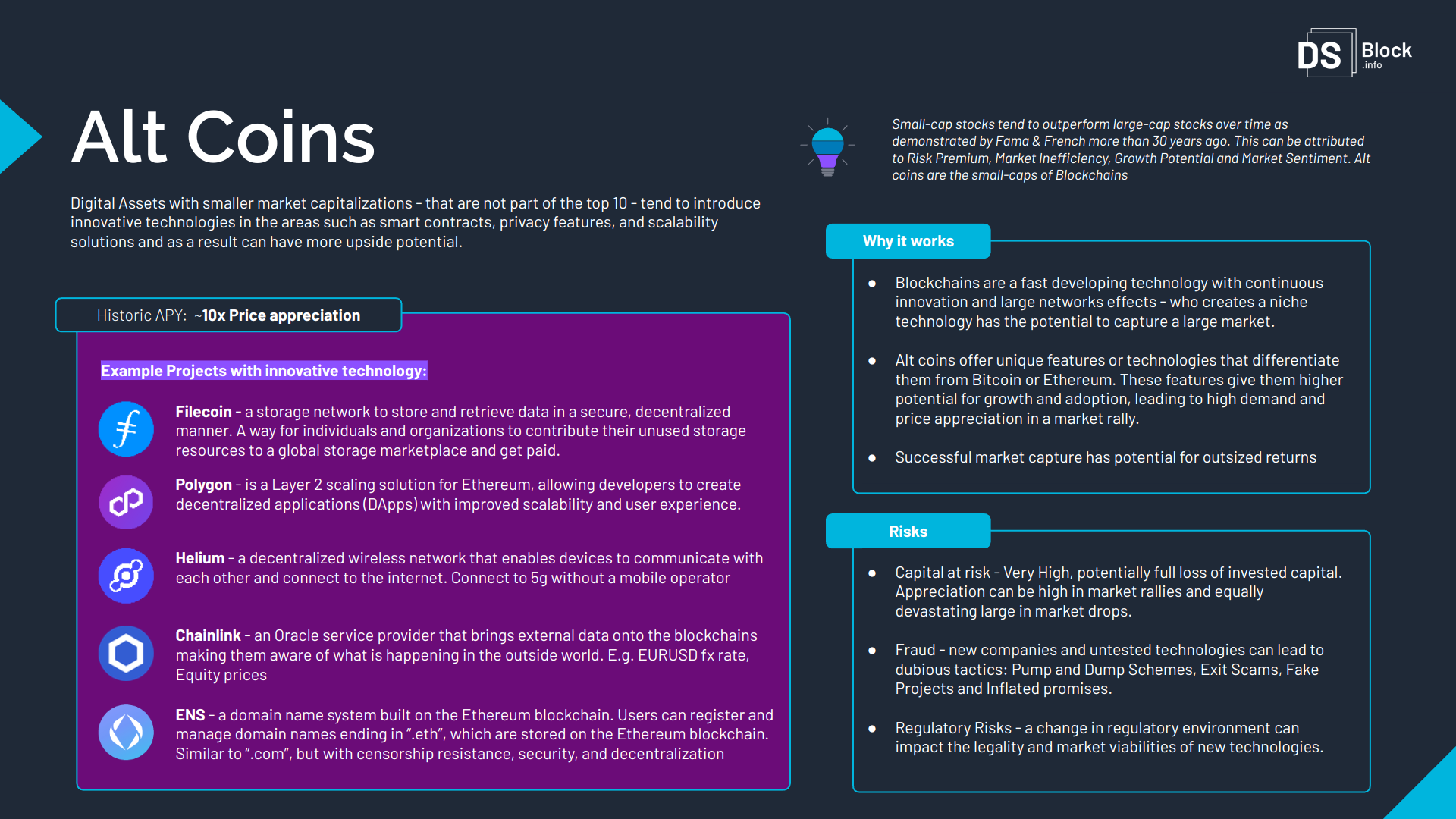

Alt Coins

Alternative Digital Assets introduce innovative technologies in the areas such as smart contracts, privacy features, and scalability solutions and they tend to innovate faster than the established Digital Assets in the top 10. Investing in these projects gives expose to cutting-edge developments in the blockchain and cryptocurrency space.

Historic price appreciation has been multiple time the original investment, but with a considerable risk of the value the of investment going down. Market risk is very high for this strategy.

Why it Works?

- Blockchains are a fast developing technology with continuous innovation and large networks effects - who creates a niche technology has the potential to capture a large market;

- Alt coins offer unique features or technologies that differentiate them from Bitcoin or Ethereum. These features give them higher potential for growth and adoption, leading to high demand and price appreciation in a market rally;

- Successful market capture has potential for outsized returns

Key Risks

- Capital at risk - Very High, potentially full loss of invested capital. Appreciation can be high in market rallies and equally devastating large in market drops.

- Fraud - new companies and untested technologies can lead to dubious tactics: Pump and Dump Schemes, Exit Scams, Fake Projects and Inflated promises.

- Regulatory Risks - a change in regulatory environment can impact the legality and market viabilities of new technologies.

Disclaimer: Please note that the information provided is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any specific asset or investment strategy. Investing in digital assets carries inherent risks, and individuals should conduct their own research and seek professional advice before making any investment decisions. We do not assume any responsibility for the accuracy or completeness of the information provided, nor do we endorse any particular investment approach.