Automated Market Making

AMMs facilitate the exchange of Digital Assets on a Decentralized Exchange. They provide an automated and algorithmic way to execute trades and determine prices without relying on traditional order books or intermediaries.

Historic yields have been between 10 and 60%, but with a considerable risk of the value the of investment going up, or down with the price of the digital asset. Therefore this strategy exposes investors to high yields and also the price of the asset.

How it Works?

- Investors deposit equal amounts of 2 assets into a liquidity pool (e.g. 100 BTC and $5mn)

- The initial price is determined by their ratio of inventories in the pool (e.g. 5mn / 100 = $50k per Bitcoin). This determines the starting price at which one asset can be swapped for the other. This price will change as traders swap assets and change the balance of inventories in the pool

- The rules of the exchange are written in a smart contract that runs 24/7 on a blockchain;

- Smart contract only allows Swaps if the product of inventories is preserved - this is an arbitrary number K, e.g. 500k*10 = 5mn, and is also known as the Constant Product AMM

- A trader can take out 1 Bitcoin from one pool only if they deposit $50.5k into the pool, in order to maintain the product of inventories 50.5k*99 = 5mn , + a fee of 0.3%. This is controlled by the smart contract.

- The 0.3% fee from every Swap goes back to the Investors who provided liquidity into the pool

Why it Works?

- Investors who provide liquidity into a pool receive a 0.3% from every swap that is done with their liquidity;

- Performs well in volatile markets when more trading is going on. More trading = more fees for liquidity providers;

- Smart contracts manage the orders, once liquidity has been added there is little intervention required;

- Has grown in popularity due to good user experience and available 24/7

Key Risks

- Capital at risk - liquidity provides always sell the asset that is going up in price and buy the asset that is falling in price, for this they receive a fee. If prices fall significantly, the loss in value can be higher than the prospect of fees;

- Smart contract risk - risk of bugs in the smart contract can lead to them being hacked and money stolen;

- Stablecoin depegging - custodian who issues stablecoins might not be able to guarantee convertibility and this can lead to losses.

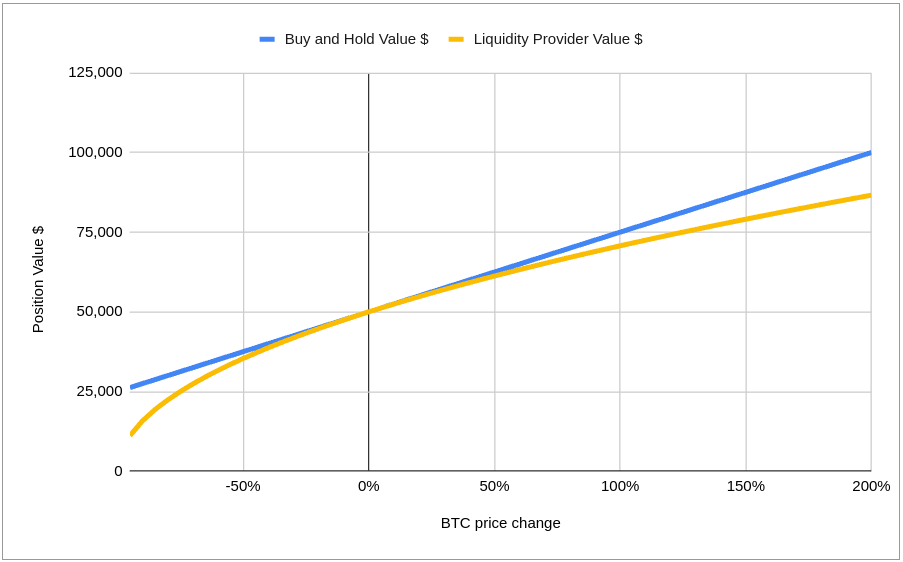

Price Risk when Providing Liquidity

Providing liquidity into a liquidity pool pays fees from the traders who use that liquidity by doing swaps. So there is a stream of fees to the liquidity provider. However, the liquidity provider is always on the wrong side of where the market is going. Traders go to a liquidity provider for liquidity. And when the market is rising, the traders are buying, which means the liquidity provider is selling.... and selling when the market is rising is not a good thing for profit.

When the market prices move the liquidity provider is always on the wrong side of the market . When the market is rising, the traders go to the liquidity provider to buy that asset, and when the market is falling the traders go to the liquidity provider to sell him the asset.

The liquidity provider always suffers from "negative gamma" which in the trader's lingo that if the market moves then he will be worse off than he started. And when the liquidity provider has negative gamma the trick is to make more profit from fees than what he loses from the negative gamma.

This is similar to selling options. The option seller gives someone an option to buy from them an asset at a certain price in the future, called the strike price. The option is very cheap if the strike price is very far away, but gets more expensive as the price rises and gets closer to the strike. This increase is not linear. And this no linearity is called the gamma effect.

The negative gamma is best illustrated with an example against a buy-and-hold strategy. The delta of the buy and hold strategy is always 1 which means for a 1% price in price the value of the portfolio changes by 1%. However, the delta of a liquidity provider is 1 only locally. As soon as the price moves away, even slightly, the change in value becomes less than the change in price - this is negative gamma.

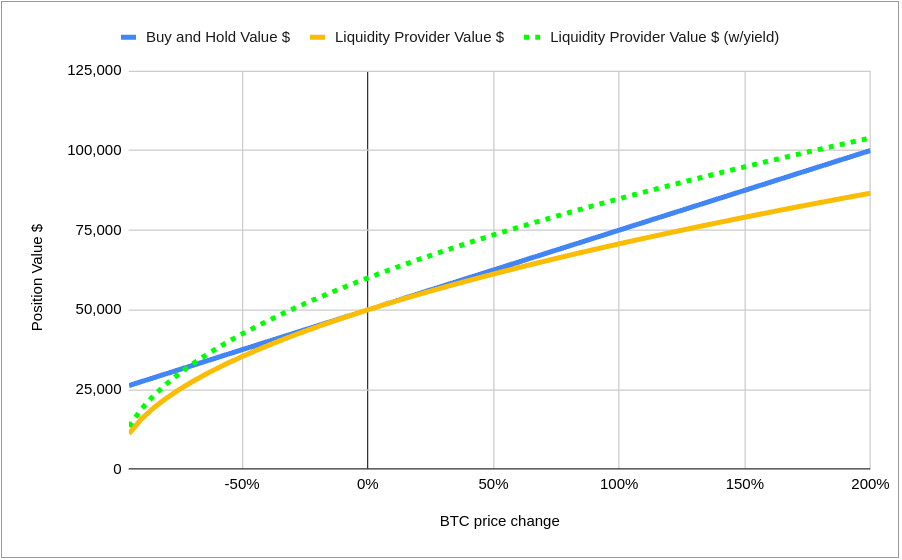

Fees

When providing liquidity into a pool it helps when there is a lot of trading going through that pool. This is because every Swap pays 0.3% in fees to the liquidity providers. The chart below illustrates the effect that fees have on the overall profitability of the strategy at the end of the year at different levels of BTC. For a sufficiently long investment time horizon the fees tend to compensate for the negative gamma and fees also give a relatively stead stream of income to the investor.

Disclaimer: Please note that the information provided is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any specific asset or investment strategy. Investing in digital assets carries inherent risks, and individuals should conduct their own research and seek professional advice before making any investment decisions. We do not assume any responsibility for the accuracy or completeness of the information provided, nor do we endorse any particular investment approach.