Delta & Staking

Holding a "delta" to Digital Assets can provide diversification to a portfolio of traditional financial markets, as a hedge against economic uncertainties. The historical growth of Digital Assets underscores their potential for substantial returns.

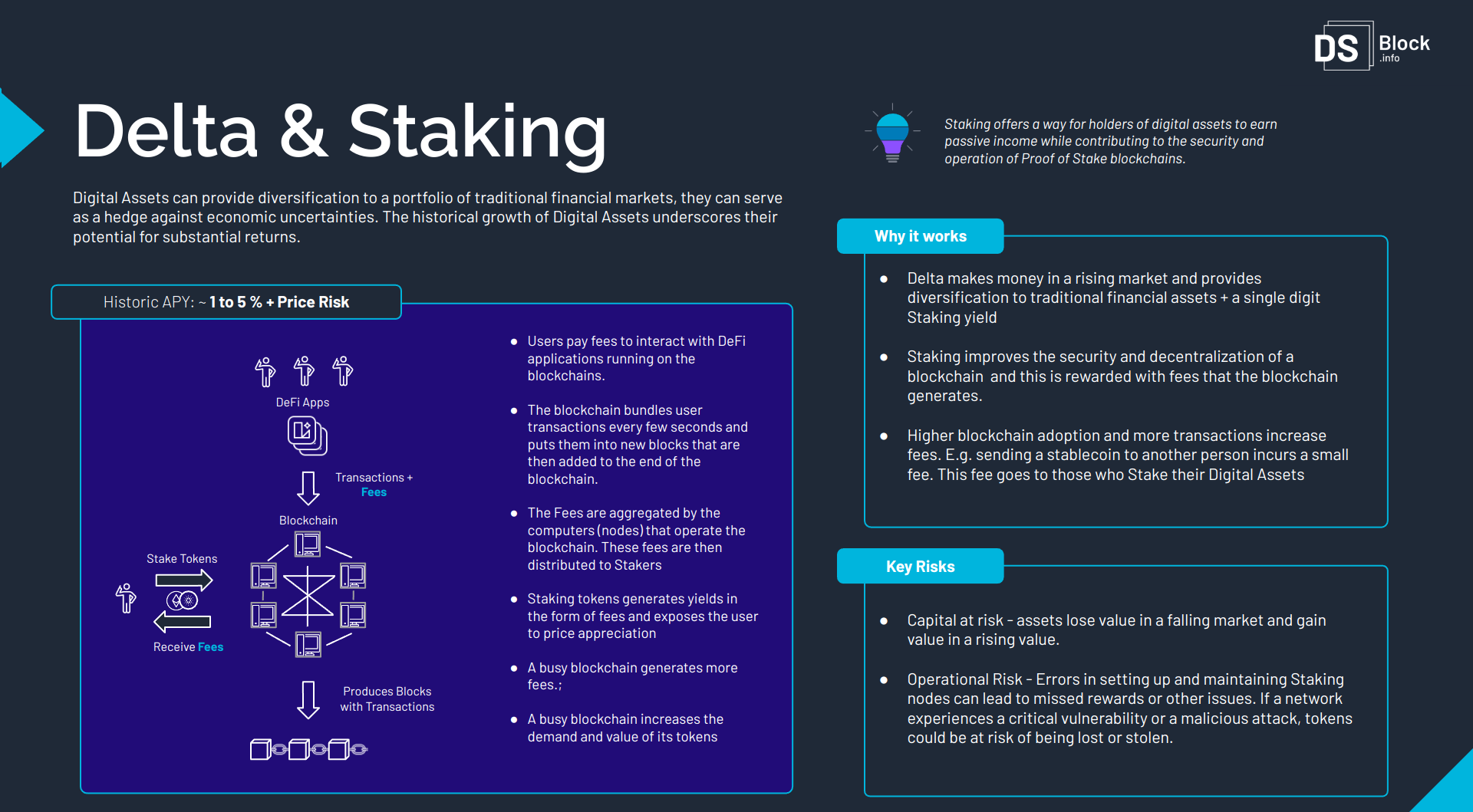

Historic yields have been between 1 and 5%, but with a considerable risk of the value the of investment going up, or down with the price of the digital asset. Therefore this strategy exposes investors to yields and also the price of the asset.

How it Works?

- Users pay fees to interact with DeFi applications running on the blockchains;

- The blockchain bundles user transactions every few seconds and puts them into new blocks that are then added to the end of the blockchain;

- The Fees are aggregated by the computers (nodes) that operate the blockchain. These fees are then distributed to Stakers;

- Staking tokens generates yields in the form of fees and exposes the user to price appreciation;

- A busy blockchain generates more fees;

- A busy blockchain increases the demand and value of its tokens.

Why it Works?

- Delta makes money in a rising market and provides diversification to traditional financial assets + a single digit Staking yield;

- Staking improves the security and decentralization of a blockchain and this is rewarded with fees that the blockchain generates;

- Higher blockchain adoption and more transactions increase fees. E.g. sending a stablecoin to another person incurs a small fee. This fee goes to those who Stake their Digital Assets.

Key Risks

- Capital at risk - assets lose value in a falling market and gain value in a rising value.

- Operational Risk - Errors in setting up and maintaining Staking nodes can lead to missed rewards or other issues. If a network experiences a critical vulnerability or a malicious attack, tokens could be at risk of being lost or stolen.

Disclaimer: Please note that the information provided is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any specific asset or investment strategy. Investing in digital assets carries inherent risks, and individuals should conduct their own research and seek professional advice before making any investment decisions. We do not assume any responsibility for the accuracy or completeness of the information provided, nor do we endorse any particular investment approach.