Futures Cash & Carry

Cash & Carry involves exploiting price differences between the spot and futures markets for the same underlying Digital Asset. The futures market usually trades at a premium to the spot market. The return exists as speculators want to bet on the direction of the market without providing the full capital for the trade (aka leverage) and are willing to pay a premium for this.

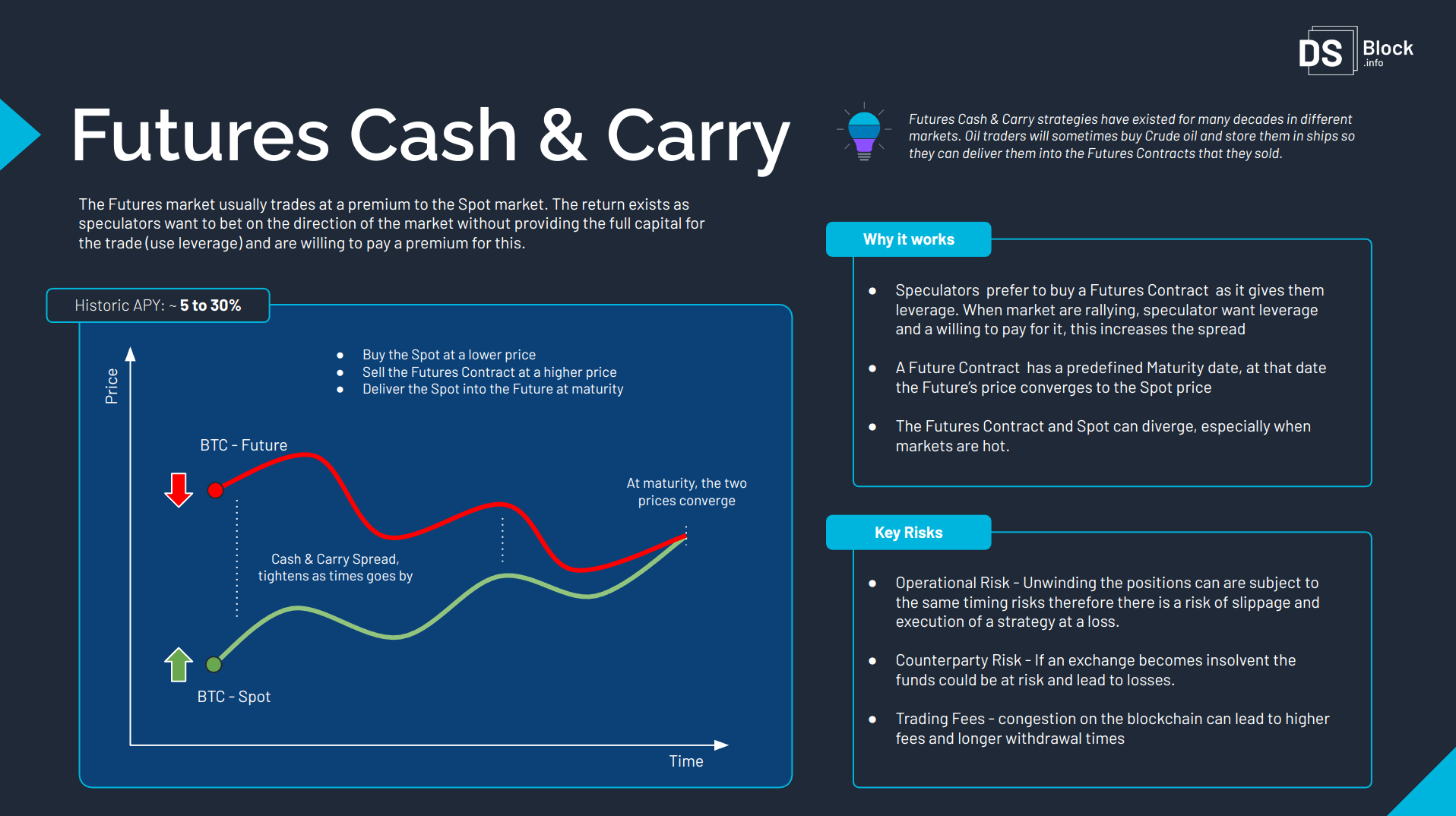

The Futures market usually trades at a premium to the Spot market. The return exists as speculators want to bet on the direction of the market without providing the full capital for the trade (use leverage) and are willing to pay a premium for this.

Historic yields have been between 5 and 30% per year.

Why it Works?

- Speculators prefer to buy a Futures Contract as it gives them leverage. When market are rallying, speculator want leverage and a willing to pay for it, this increases the spread

- A Future Contract has a predefined Maturity date, at that date the Future’s price converges to the Spot price

- The Futures Contract and Spot can diverge, especially when markets are hot.

Key Risks

- Operational Risk - Unwinding the positions can are subject to the same timing risks therefore there is a risk of slippage and execution of a strategy at a loss.

- Counterparty Risk - If an exchange becomes insolvent the funds could be at risk and lead to losses.

- Trading Fees - congestion on the blockchain can lead to higher fees and longer withdrawal times

Disclaimer: Please note that the information provided is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any specific asset or investment strategy. Investing in digital assets carries inherent risks, and individuals should conduct their own research and seek professional advice before making any investment decisions. We do not assume any responsibility for the accuracy or completeness of the information provided, nor do we endorse any particular investment approach.