Market Update 03-May-2024

A summary of the current market conditions

Table of Content

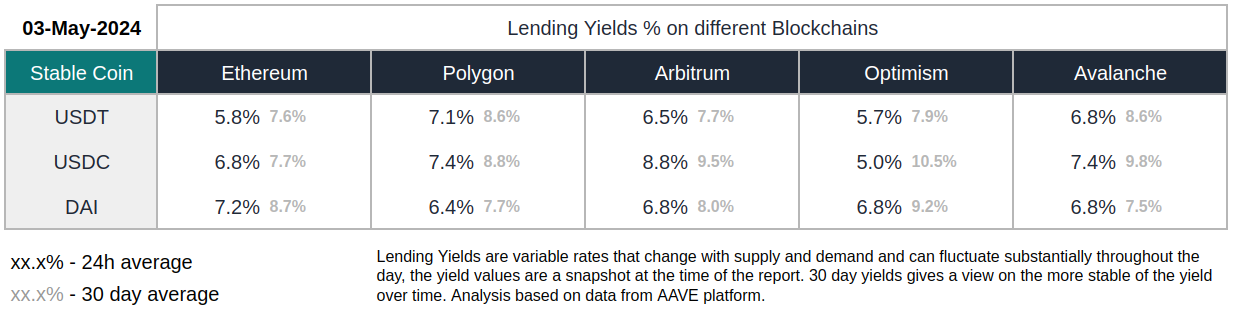

Stable Coin Lending

Lending rates reduce this week and have been around 7% for USDT and USDC on most chains, this is down from around 10% from a couple of weeks ago. Demand for leveraged trading, that drives some of these high rates, has also dropped off this week.

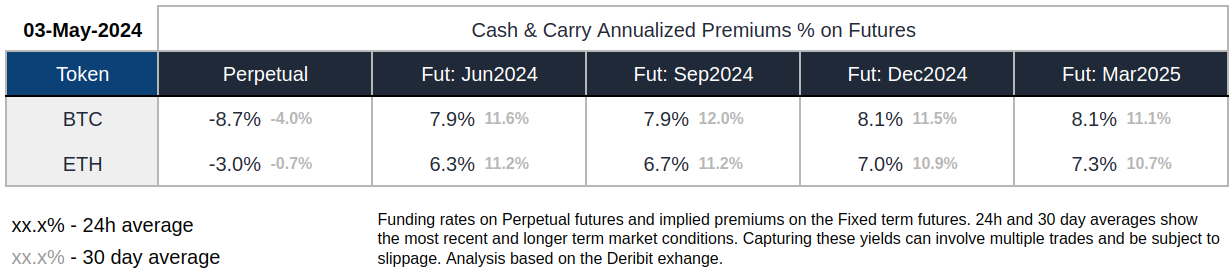

Futures Cash & Carry

Demand for Futures reduced further this week with funding rates on perpetuals remaining significantly negative on BTC -8.7% and ETH -3%. Longer term futures have been coming down as well. The Sep2024 ETH future is now at $92 above the index price which is significantly down from $224 two weeks ago.

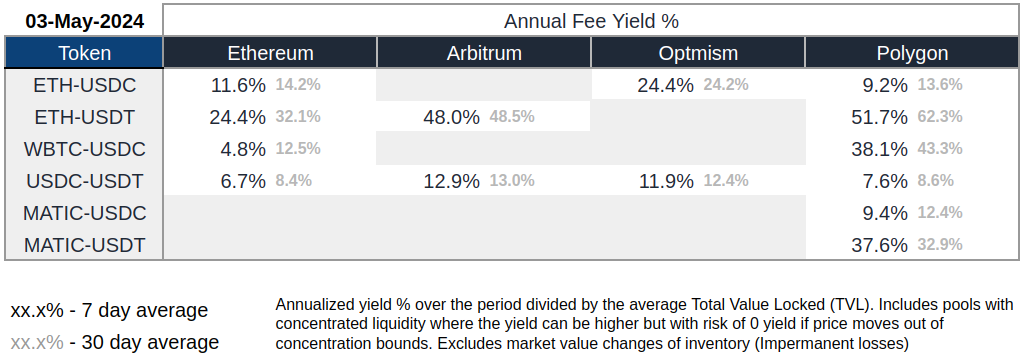

Automated Market Making

Markets were volatile this week which pushed up the fees collected from the AMMs well above double digits across most pairs. AMMs tend to perform well in high volatility environments.

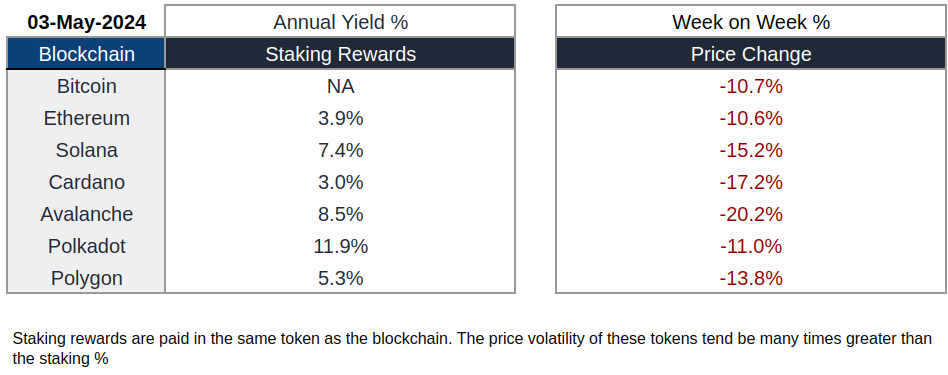

Delta & Stake

Staking rewards incentivize participants to secure the network, validate transactions, and contribute to the overall health and decentralization of the ecosystem. Staking rewards are relatively stable and tend to decrease over time as blockchains spend their treasuries which in part are used to subsidize these rewards.

Crypto market sold off double digits in the last couple of weeks

Disclaimer: Please note that the information provided is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any specific asset or investment strategy. Investing in digital assets carries inherent risks, and individuals should conduct their own research and seek professional advice before making any investment decisions. We do not assume any responsibility for the accuracy or completeness of the information provided, nor do we endorse any particular investment approach.