Market Update 12-Apr-2024

A summary of the current market conditions

Table of Content

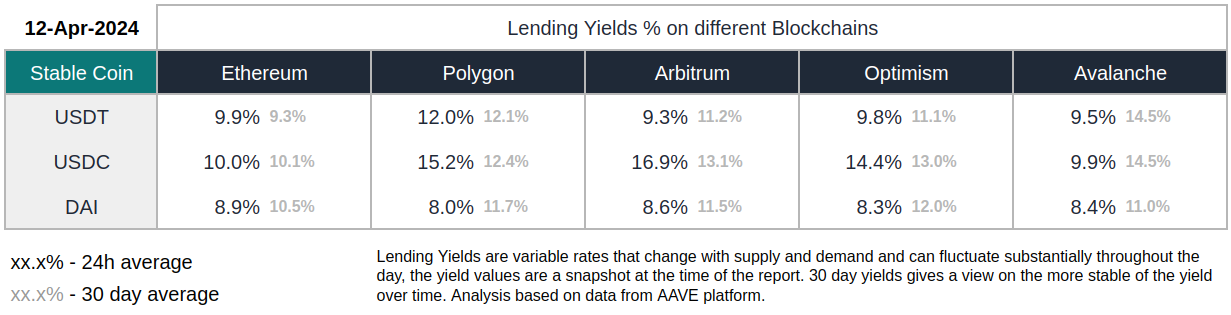

Stable Coin Lending

Lending rates remained high this week, well above 10% for USDT and USDC on most chains. However demand for leveraged trading, that drives some of these high rates, has dropped off this week so we might see these lending rates come down over the next weeks.

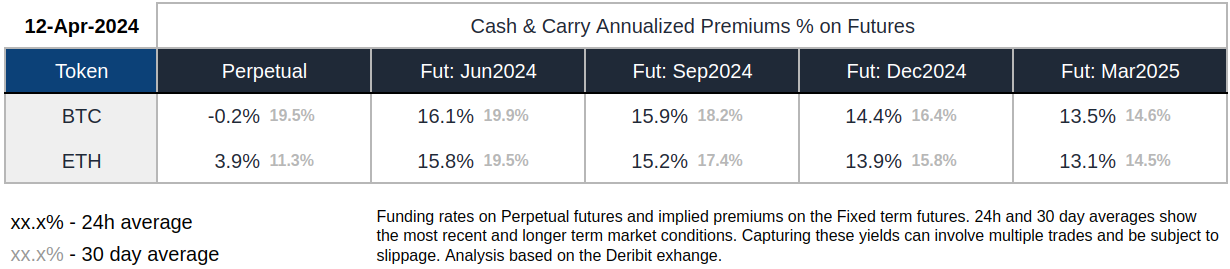

Futures Cash & Carry

Demand for Futures reduced further this week with funding rates on perpetuals remaining negative on BTC and just above 0% on ETH. Longer term futures have been coming down as well. The Sep2024 ETH future remained roughly unchanged at $224 above the index price.

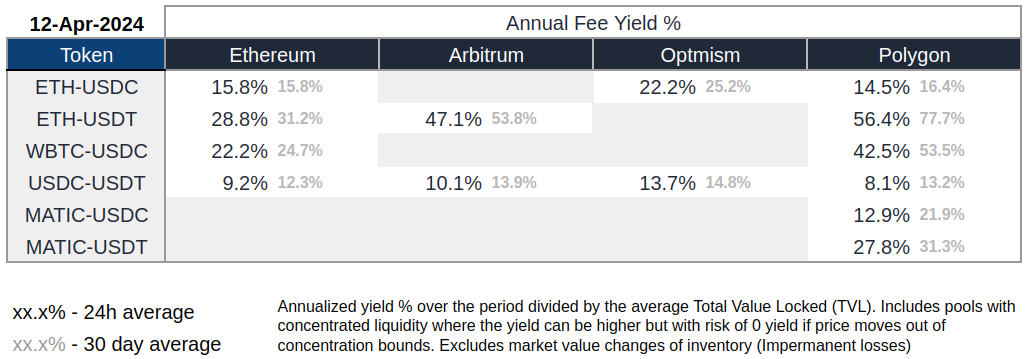

Automated Market Making

Markets were volatile this week which pushed up the fees collected from the AMMs well above double digits across most pairs. AMMs tend to perform well in high volatility environments.

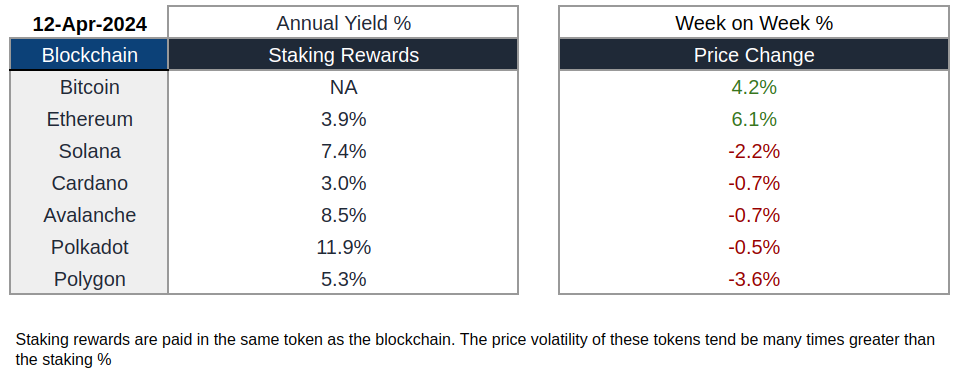

Delta & Stake

Staking rewards incentivize participants to secure the network, validate transactions, and contribute to the overall health and decentralization of the ecosystem. Staking rewards are relatively stable and tend to decrease over time as blockchains spend their treasuries which in part are used to subsidize these rewards.

Bitcoin and Ethereum outperformed the rest of the market this week.

Disclaimer: Please note that the information provided is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any specific asset or investment strategy. Investing in digital assets carries inherent risks, and individuals should conduct their own research and seek professional advice before making any investment decisions. We do not assume any responsibility for the accuracy or completeness of the information provided, nor do we endorse any particular investment approach.