Stable Coin Lending

Stablecoins are Digital Assets designed to have a relatively stable value, usually pegged to USD. Unlike many other cryptocurrencies like Bitcoin or Ethereum, which can be highly volatile, stable coins aim to provide a stable and predictable value, making them suitable for financial transactions and applications.

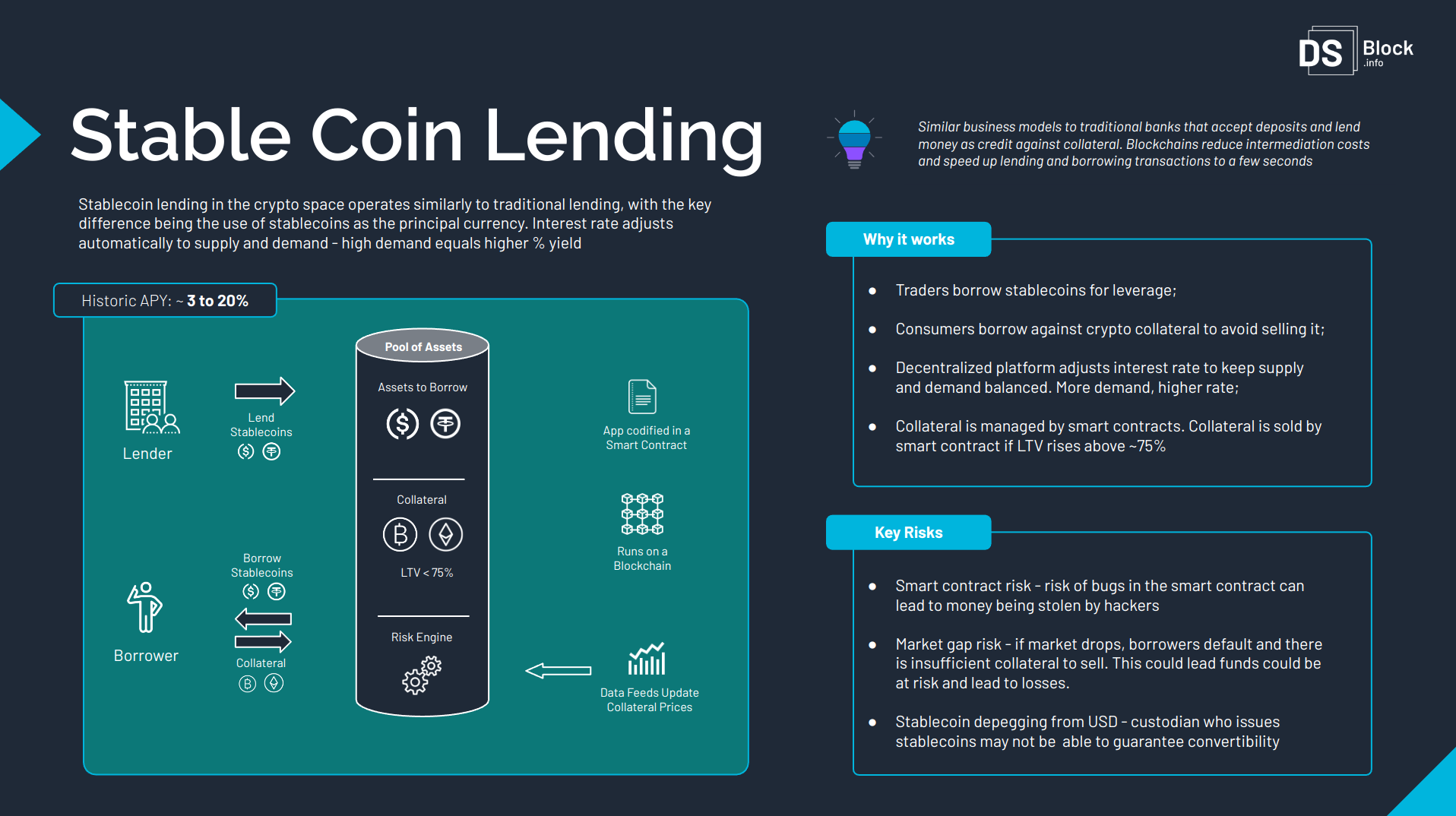

Stablecoin lending in the crypto space operates similarly to traditional lending by financial instituyions, with the key difference being the use of stablecoins as the principal currency and being done on blockchains. Interest rate adjusts automatically to supply and demand - high demand equals higher % yield. Historic yields for lenders have been between 3 and 20% per year.

Blockchains reduce intermediation costs and speed up lending and borrowing transactions to a few seconds and reduce transactional costs, in some cases to under a $1 depending on the fees of individual blockchains

Why it works?

- Traders borrow stablecoins for leverage;

- Consumers borrow against crypto collateral to spend in shops and avoid selling crypto;

- Decentralized platform adjusts interest rate to keep supply and demand balanced. More demand, higher rate;

- Collateral is managed by smart contracts. Collateral is sold by smart contract if LTV rises above ~75%

Main Risks

- Smart contract risk - risk of bugs in the smart contract can lead to money being stolen by hackers;

- Market gap risk - if market drops, borrowers default and there insufficient collateral to sell funds could be at risk and lead to losses;

- Stablecoin depegging from USD - custodian who issues stablecoins may not be able to guarantee convertibility

Disclaimer: Please note that the information provided is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any specific asset or investment strategy. Investing in digital assets carries inherent risks, and individuals should conduct their own research and seek professional advice before making any investment decisions. We do not assume any responsibility for the accuracy or completeness of the information provided, nor do we endorse any particular investment approach.